The Number ONE Platform for Iconic Restaurant Brands in MENA

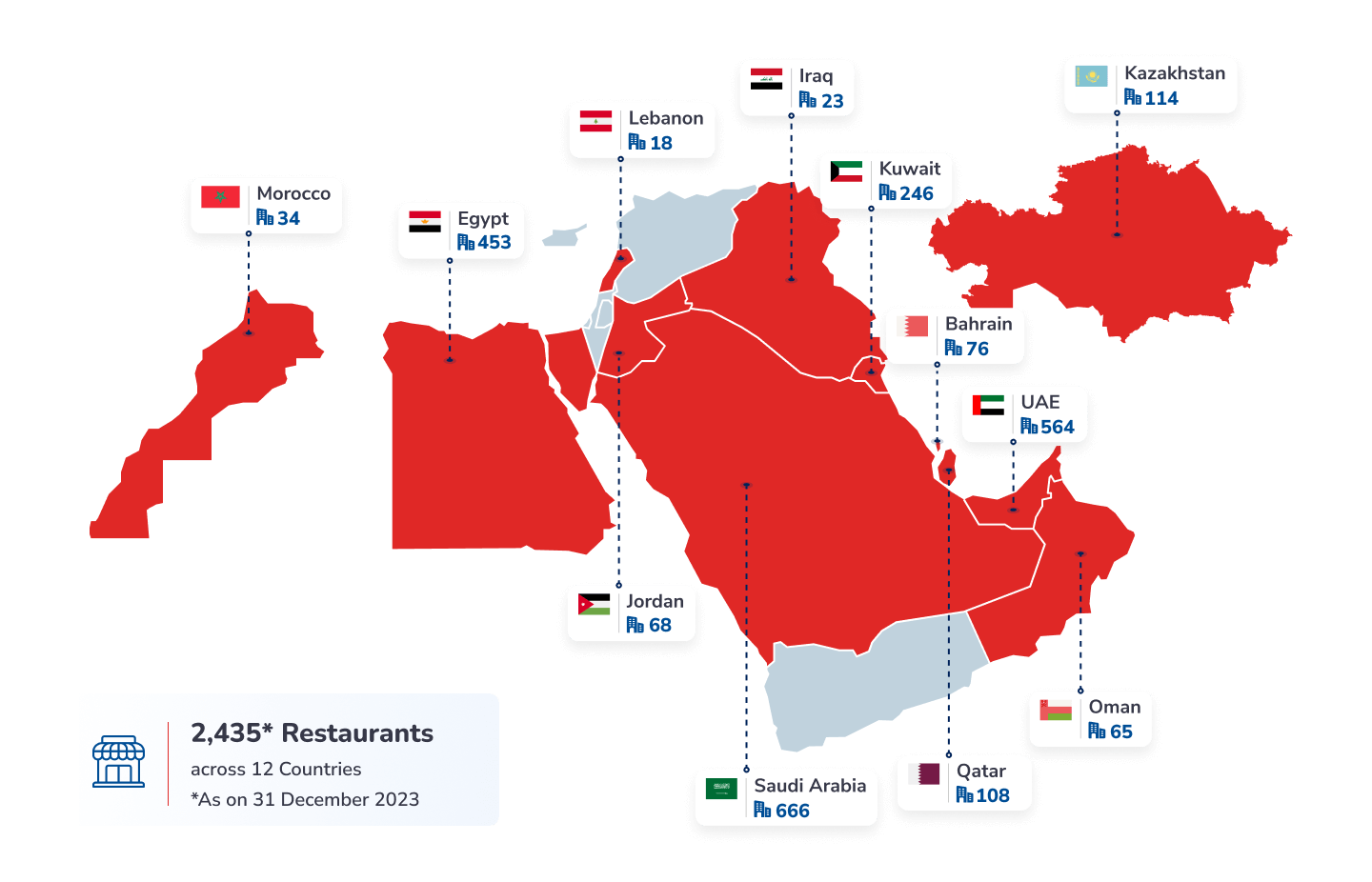

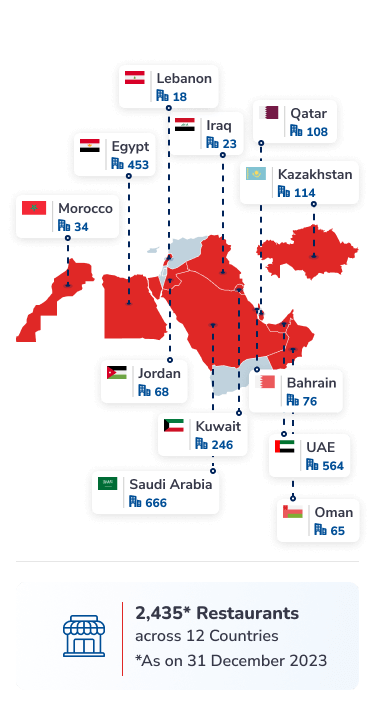

Americana Restaurants is the largest restaurant operator in the MENA region and Kazakhstan in terms of number of restaurants in its countries of operations. Americana Restaurants operates iconic global brands such as KFC, Pizza Hut, Hardee’s, Krispy Kreme, TGI Fridays, and recently added Peet’s Coffee, along with proprietary brands such as Wimpy and Chicken Tikka across the MENA region and Kazakhstan for over fifty years.

0

ICONIC BRANDS

Diversified and relevant portfolio.

0

COUNTRIES

Present in major countries in MENA region and Kazakhstan.

0*

Restaurants

Serving consistent quality and experience. *As of 31 December 2023

0+

EMPLOYEES

Performance and values driven.

The strength of Americana Restaurants is in the diversity of its portfolio which covers some of the most popular food categories including QSR, casual dining, indulgence, and coffee. Americana leverages the worldwide appeal and recall of its iconic brands, sustained focus on customer satisfaction, implementation of digital measures to increase efficiency in operations and enhance the customer experience. It replicates, improves and adapts to local tastes the tried-and-tested dining solutions from some of the world’s most popular brands with multi-decade global brand equity and high embedded customer trust, appeal and preference.

Our vision-mission-purpose resonates equally with team members in our restaurants, as well as our shareholders. Our focus on team members and customers is central to our success.